The Buzz on Bankruptcy

Table of ContentsExcitement About Bankruptcy AustraliaBankruptcy Lawyers Near Me - TruthsThe Main Principles Of Bankruptcy Court Unknown Facts About Bankruptcy BillHow Bankruptcy Court can Save You Time, Stress, and Money.The Main Principles Of Bankruptcy Attorney Near Me

Nonetheless, the 2 kinds of bankruptcy eliminate financial obligation in different ways. Chapter 7 insolvency, also understood as "straight personal bankruptcy," is what many people possibly believe of when they're considering applying for insolvency. Under this sort of bankruptcy, you'll be called for to enable a government court trustee to monitor the sale of any kind of assets that aren't excluded (cars and trucks, occupational devices as well as basic home furnishings might be exempt).Here are a few of one of the most usual as well as important ones:: This is the person or company, assigned by the bankruptcy court, to act on behalf of the financial institutions. He or she evaluates the debtor's petition, sells off building under Chapter 7 filings, and also distributes the proceeds to financial institutions. In Chapter 13 filings, the trustee additionally supervises the borrower's repayment strategy, obtains settlements from the borrower and disburses the cash to lenders.

Once you've filed, you'll likewise be required to complete a program in personal monetary management before the insolvency can be discharged. Under certain scenarios, both demands could be waived.: When bankruptcy procedures are full, the bankruptcy is taken into consideration "discharged." Under Phase 7, this takes place after your possessions have been sold and also creditors paid.

The Main Principles Of Bankruptcy Benefits

The Bankruptcy Code needs people that want to submit Phase 7 insolvency to show that they do not have the means to settle their debts. The need is planned to reduce misuse of the insolvency code.

If a borrower stops working to pass the ways examination, their Chapter 7 insolvency may either be dismissed or converted into a Phase 13 case. Under Chapter 7 personal bankruptcy, you might consent to continue paying a financial obligation that could be discharged in the process. Reaffirming the account and your dedication to pay the debt is typically done to allow a debtor to keep an item of collateral, such as an automobile, that would certainly or else be confiscated as component of the insolvency proceedings.

Bankruptcies are considered adverse details on your credit record, and also can affect how future lending institutions watch you - Bankruptcy. Seeing a personal bankruptcy on your debt data might motivate financial institutions to decline prolonging you credit rating or to use you greater interest prices as well as much less positive terms if they do make a decision to give you credit rating.

The Main Principles Of Bankruptcy Information

Bankruptcy information on your debt report might make it extremely difficult to obtain added debt after the insolvency is released at the very least till the information cycles off your credit scores report.

Research financial obligation consolidation fundings to see if combination can decrease the complete amount you pay as well as make your financial obligation more convenient. Skipping on your debt is not something your financial institutions desire to see occur to you, either, so they might agree to collaborate with you to prepare a much more achievable payment strategy.

Indicators on Bankruptcy Lawyers Near Me You Need To Know

Monitoring your credit history report. Developing and staying with an individual budget plan. Using debt in tiny ways (such as a safeguarded credit history card) as well as paying the equilibriums in full, today.

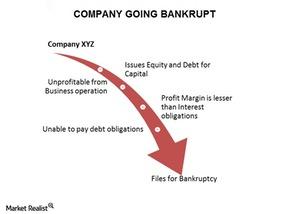

Personal bankruptcy is a lawful proceeding started when an individual or organization is unable to settle exceptional financial debts or commitments., which is less common.

All personal bankruptcy instances in the United States are managed via government courts. Any kind of choices in government bankruptcy cases bankruptcy filing are made by a personal bankruptcy judge, consisting of whether a borrower is qualified to submit and whether they need to be discharged of their financial obligations. Administration over personal bankruptcy instances is often managed by a trustee, a police officer designated by the USA Trustee Program of the Department of Justice, to represent the borrower's estate in the proceeding.

The Single Strategy To Use For Bankruptcy Australia

Their preferred investors, if any kind of, might still receive settlements, though common investors will not. A housekeeping business filing Phase 11 insolvency may enhance its rates a little and also supply more services to come to be profitable. Phase 11 personal bankruptcy enables business to proceed performing its service activities without disruption while servicing a financial obligation settlement strategy under the court's supervision.

Phase 12 personal bankruptcy offers relief to family farms and fisheries. They are permitted to maintain their organizations while functioning out a strategy to settle their debts. Phase 15 insolvency was contributed to the legislation in 2005 to additional reading manage cross-border situations, which include borrowers, possessions, financial institutions, and other celebrations that may remain in more than one country.

However, not all debts qualify to be discharged. Several of these consist of tax obligation claims, anything that was not provided by the borrower, kid assistance or alimony repayments, injury financial debts, as well as debts to the federal government. In enhancement, any protected financial institution can still apply a lien versus property owned by the borrower, offered that the lien is still legitimate.

How Bankruptcy Attorney Near Me can Save You Time, Stress, and Money.

When a request for personal bankruptcy has actually been filed in court, creditors obtain a notification and can object if they select to do so. If they do, they will need to file a grievance in court before the get redirected here due date. This results in the declaring of an enemy continuing to recoup money owed or enforce a lien.